Author: Marián Šeliga, Head of China desk at J&T bank a.s.

Over the past week, a wave of articles and interviews has focused on how political developments in Venezuela may affect China—particularly with regard to servicing Venezuela’s USD 10–16 billion debt to Chinese state banks and the continuation of Venezuelan oil supplies to the Chinese market. Most China specialists have argued that while Beijing has strongly condemned these developments politically, their economic impact on China is limited or, at the very least, exaggerated. Venezuelan crude accounts for no more than around 4% of China’s total oil imports, a volume that can be relatively easily replaced by alternative suppliers at only a modest additional cost.

What should genuinely concern Beijing, however, is not Venezuela but Iran.

Iran is currently experiencing sustained and intensifying protests against the ruling Islamic Republic. Protesters are increasingly calling not merely for reforms but for a complete regime change, including the restoration of the monarchy and the return of Prince Reza Pahlavi, the son of the Shah overthrown during the 1979 Islamic Revolution. These political dynamics pose a far more serious strategic challenge for China than the situation in Caracas.

While Iran is not China’s single largest oil supplier—that position is currently held by Russia, followed by Saudi Arabia and Iraq—it remains one of China’s most important and politically sensitive energy partners. Under the Western sanctions regime, Iran has relied heavily on China as its primary buyer of crude oil, often selling at a discount and through opaque shipping and trading arrangements. For Beijing, this relationship has been highly advantageous: China has secured a steady flow of discounted oil while largely ignoring concerns over Iran’s human rights record and domestic political system. Tehran, in turn, has benefited from having a reliable long-term customer willing to operate outside the Western sanctions framework.

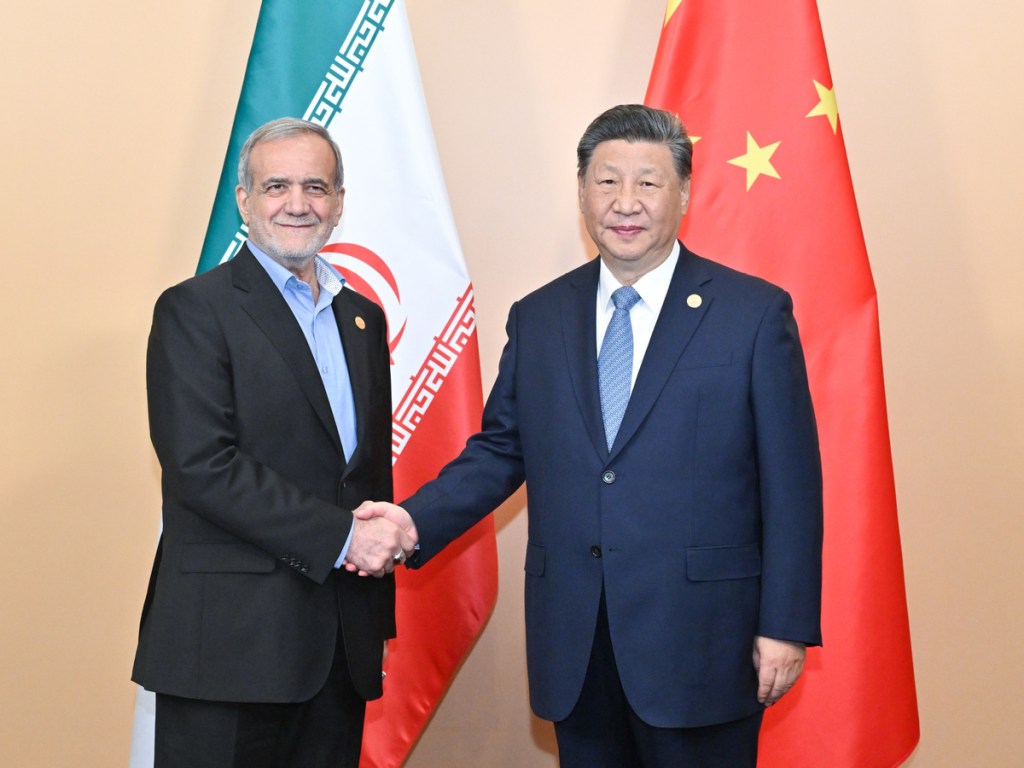

According to China’s Guancha media outlet, a comparison of crude import prices from Russia, Saudi Arabia, and Iran shows that Iranian oil is priced even below discounted Russian crude. This has made Iran an important component of China’s energy supply structure and helps explain Beijing’s decision to elevate bilateral relations to a comprehensive strategic partnership. China opposes any external interference in Iran as the country faces more than a week of protests.

This delicate balance, however, may now be under serious threat. The brief but intense 12-day war last summer—aimed primarily at degrading Iran’s nuclear program, including uranium enrichment infrastructure—served as an early warning to Beijing that Iran’s external security environment and internal stability could deteriorate rapidly. The latest wave of domestic unrest suggests that the risks may be even deeper and more structural than previously assumed.

Should Iran undergo a fundamental political transformation—particularly in the event of a restoration of the monarchy—the country’s foreign and energy policies could shift dramatically. A new leadership might seek rapprochement with the West, leading to the easing or even removal of sanctions. In such a scenario, Iran would likely diversify its energy partnerships, reduce its dependence on China, and reassess long-term oil supply arrangements concluded under sanctions pressure.

For China, this would mean the loss of a privileged position it has enjoyed in Iran’s energy sector for more than a decade. This could be especially unsettleing for the independent oil refiners. Beijing would then face a strategic choice: either begin cautiously engaging with elements of the Iranian opposition to hedge against a possible regime change, or prepare for deeper reliance on alternative suppliers—most notably Russia—to offset potential disruptions in Iranian oil flows.

In this sense, the events unfolding in Iran represent a far more consequential and potentially destabilizing challenge for China’s long-term energy security than the political turmoil in Venezuela.