Author: Marián Šeliga

The Chinese top political event of this year is over. But China’s economy needs to cope with serious challenges to stay afloat.

These days, much attention has been paid to China’s main political event – the 20th Congress of the Communist Party, which re-elected Xi Jinping as head of the CPC for another five-year term. Xi cemented his power in the most powerful political body, the Politburo Standing Committee, by installing loyal candidates into it. The congress will be remembered for another highlight when former President Hu Jintao was escorted out of the congress hall on the eve of the decisive vote. This could have been a symbolic demonstration of Xi Jinping’s power: Xi is no longer just “Primus inter pares”, he is a supreme leader with a historic mission.

Although the political situation in China has recently been discussed a lot by most of the world’s media, the state of the Chinese economy, which is still considered the second economy in the world, is somehow overlooked. The situation in the latter, to put it mildly, is far from ideal. China’s economy is facing challenges ranging from a real estate crisis to high youth unemployment. The purpose of this brief analysis is to point out 6 urgent problems that pose a sufficient threat to the further socio-economic development of China.

1. Soaring youth unemployment and the “lying flat” movement

As China has grown economically over the years, it has produced more and more university graduates. The growth in the number of the latter naturally led to fierce competition in the labor market and, as expected, to a high level of unemployment. China’s youth unemployment reached 19.9% in July 2022, according to data released by the country’s National Bureau of Statistics. That’s the highest rate since Beijing started publishing the index in January 2018, when the rate was around 9.6%. What’s more, there is a growing number of young employees who face daily work overloads and great competition, embracing a new movement called “lying flat”. Tired of the so-called “996” work model, it is becoming increasingly difficult for Chinese millennials to overcome some class barriers or achieve higher status or promotions, even if they work hard. As a result, they usually take a break from work or even quit and do the bare minimum to get by. This movement has become very popular, especially in the major Chinese cities of Beijing, Shanghai, Guangzhou or Chongqing, which are struggling with high real estate prices and growing competition among young employees.

Subscribe and receive a weekly in-depth analysis on top international issues.

2. ZERO Covid Policy

The Draconic ZERO Covid policy is considered as a highly negative factor crippling economic growth of China. Quarantine measures and lockdowns which are constantly introduced in Chinese cities, create great discomfort for economic activity and increase the cost of the production process. The hopes of both Chinese citizens, expats and foreign businessmen that Xi Jinping would abandon the “Zero Covid” policy at the 20th Party Congress were dashed in his CCP report. Xi Jinping made it clear that there would be no wavering on zero-Covid because of the need to prioritise saving people’s lives.

3. Low economic growth

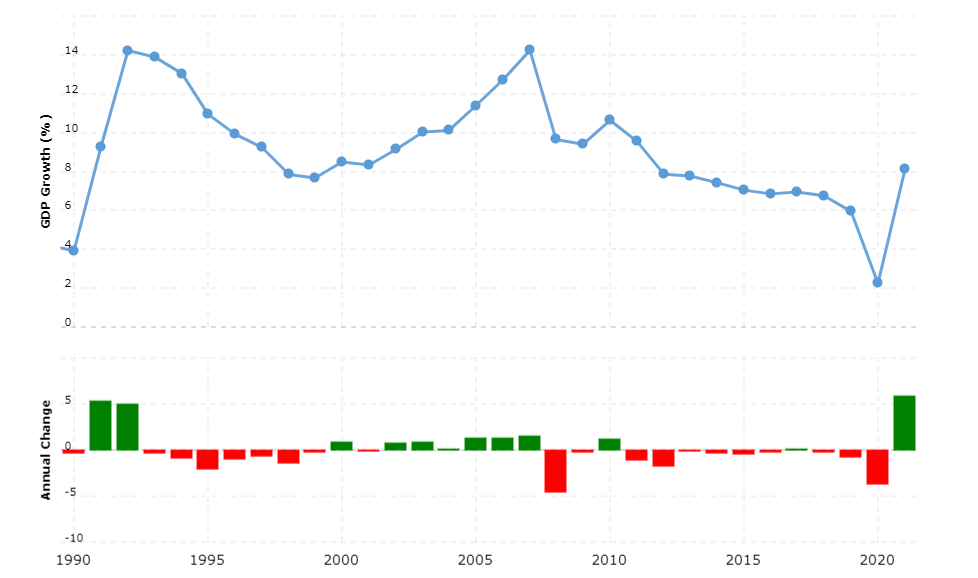

At least until 2019, when the coronavirus pandemic began, we were used to seeing high numbers in China’s economic growth. For example, from around the early 1990s to 2010, China’s GDP grew by more than 10% per year. Since then, economic growth has slowed, but has always been above 6%.

The COVID pandemic, problems in the banking and construction sectors, as well as the technological war with the United States brought down the growth rate of Chinese GDP this year (2022) to 2.2-4.1%, while the official goal is set at “about 5.5%”.

China’s economy advanced 3.9% yoy in Q3 of 2022, exceeding market consensus of 3.4% and picking up from a 0.4% growth in Q2, boosted by various measures from Beijing to revive activity. For the first nine months of the year, China’s GDP grew by 3%, with Beijing no longer mentioning about the target of 5.5% for 2022 but pledged easier lending and other measures to boost growth. A slowdown in economic growth is not only undesirable, but also puts greater pressure on the stability of the social system.

4. Overextended real estate sector

The real estate market is one of the most important sectors of the Chinese economy. According to statistics this sector accounts for around 30% of the total gross domestic product (GDP) and 30-40% of all bank loans issued. The problems with the Chinese developer Evergrande and the subsequent bankruptcies of other developers, coupled with the mortgage payment boycott of citizens left with debts and without apartments, are a ticking time bomb for the Chinese economy.

Simply put, a common headache for China’s entire real estate market is its over-indebtedness. This is due to the long-term lack of regulation of financial institutions as well as non-banks, which has led to a virtually uncontrollable rise in property prices, construction mania and over-indebtedness of China’s real estate sector.

Although the Chinese government has already taken steps to cope with challenges on the property market with so-called “three red lines” policy, the situation seems to be very complicated and there is no green light at the end of the tunnel. The demand for new houses is at a record low level and the property rates have contracted.

5. Technological war with US

Since President Trump came to power, Sino-US relations have gradually deteriorated. This dynamic of deterioration in mutual relations continued under President Biden, who, in addition to trade restrictions implemented by the previous administration, is betting on limiting the export of the most advanced technologies to China, thus hampering the latter’s technological progress.

The US Bureau of Industry and Security (BIS) has lately announced new rules limiting China’s ability to procure most advanced chips, chip-making equipment and supercomputer components. It is important to point out that the recently adopted rules are of extraterritorial nature therefore they also apply to items produced outside the USA by companies which use American technology or software.

While the recent meeting between Xi Jinping and President Biden on the sidelines of the G20 summit may signal that both countries are not interested in a new cold war, the US administration is likely to continue its policy of slowing down China’s technological progress.

6. Approaching ‘middle-income trap’

There is a golden rule which fits for many economies including the Chinese economy which says that it is much easier to catch up from a low base, while it is much more difficult to grow for many years at high rates especially when the economy is approaching its technological barrier. But when you approach your limits for growth, you need more advanced technology which is more costly than just using existing technologies or buying copyrights. With growing labour costs in China, low-added-value industries and factories move to other countries where the labor cost is cheaper. China is in fact falling into what is known as the “middle income trap,” making it unable to change its development model or strategy to move on to the next phase of more advanced economic growth.

To sum up, we believe that the next term of China’s Secretary General in power will be overshadowed by growing economic challenges caused both by internal reasons (oversaturated real estate market, high youth unemployment, tough COVID policy) as well as by unfavorable international conditions with the US practically restricting the export of cutting-edge technologies to China and stranded relations with the EU. The situation in the Chinese economy is aggravated by the consequences of the war in Ukraine, which threatens the BRI initiative in Eastern Europe and creates instability in the global commodity market. The development of the Chinese economy has a direct impact on the world economy and should be the subject of further analysis.