Photo by: Adobe stock

Author: Marián Šeliga

The aim of this article is to shed light on the following issues: Semiconductors and the unique role of Taiwanese TSMC in their production. China’s unprecedented progress in semiconductor manufacturing and its attempt to achieve self-sufficiency in chip manufacturing. Creation of the New “Chip 4 Alliance”.

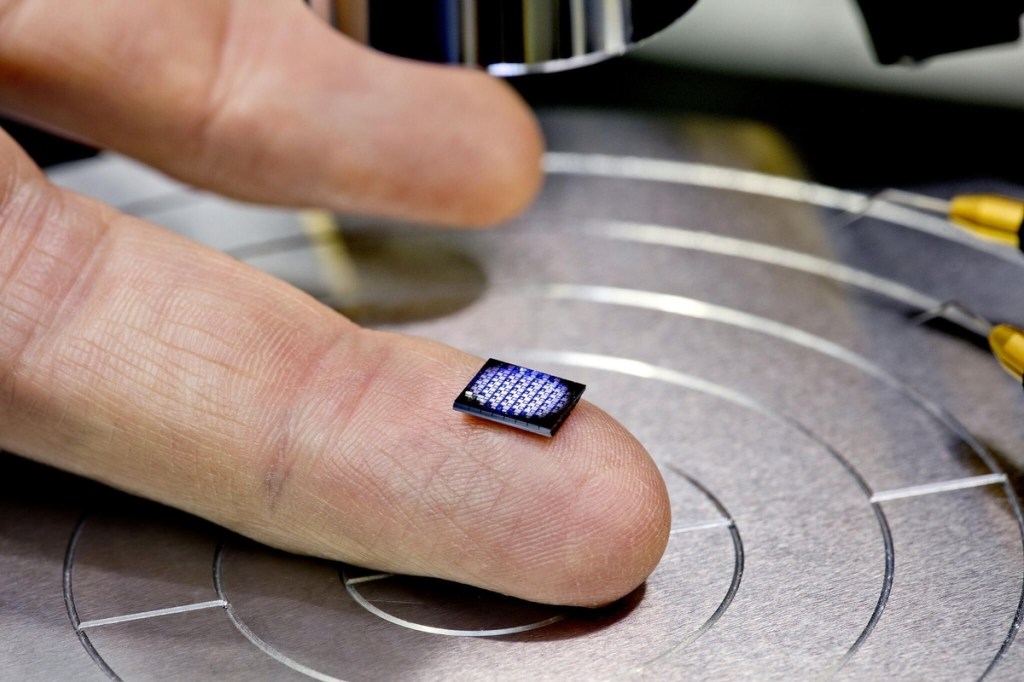

The US government’s latest decision to step up cooperation with the largest Asian chip makers within a so-called “Chip 4 alliance” excluding China clearly demonstrates that future rivalry between China and the US will take place predominantly in the high-tech sector. In this regard, the US “Chips and Science Act” passed in August is primarily aimed at supporting domestic chip manufacturing, as well as countering China’s progress and growing influence in the field of semiconductors. It goes without saying that Beijing cannot fully enjoy the status of an economic superpower without technological sovereignty in the production of semiconductors. Beijing is fully aware of its dependence on foreign chips and is therefore actively funding its own semiconductor research and development programs. Semiconductors have already become a necessary part of our daily lives: cars, planes, mobile phones and computers are all equipped with chips. The latter not only play an ever-increasing role in the technological progress of mankind, they have also become perhaps the most powerful tool of geo-economic policy.

With growing interdependencies in the global economy, especially in the field of semiconductors, there is a high risk that any instability in the Indo-Pacific region could hit the global economy hard. Take Taiwan, which is the largest semiconductor manufacturer in the world. In the event of an invasion of Taiwan, the supply chain in the semiconductor manufacturing and distribution process would be severely hampered and further disruptions could occur. Taiwanese security sensitivities and the fact that TSMC manufactures about 92% of chips designed by American semiconductor companies may have prompted the US Senate to place more importance on cooperation in chip manufacturing and pass the “Chips and Science Act.” On the other hand, supply chains and global cooperation in the production of chips are so specific ang globally interconnected that it is practically impossible to have autonomous production, say, within one country. Even the Taiwanese company TSMC is very dependent on parts suppliers scattered around the world. Also, the suppliers of spare parts are not always concentrated in countries that can be described as democratic regimes or as allies of Western countries. So the US attempt to cooperate with its allies in the semiconductor industry makes sense at least in terms of maintaning the leadership in this very important industry.

At the same time, it is very likely that the US will continue to pursue a policy of not sharing its most advanced technological achievements with China and will use its technological superiority and strong relationships with allies to curb the economic growth of rogue states. In 2020, Washington pushed the Dutch government to ban any export of ASML’s most sophisticated lithographic equipment to China. In 2022, after the Russian invasion of Ukraine, the US forced Taiwanese TSMC to stop deliveries to Russia.

After China’s Huawei was cut off from American chips in 2019 and especially after Russia’s invasion of Ukraine, Beijing found itself in a precarious position. Since China is still very dependent on imported chips, it is trying to pursue a pragmatic and cautious policy, minimizing the possibility of becoming the target of US secondary sanctions. There is also a strong dependence of the Chinese electronics industry on the Taiwanese chip industry, with TSMC alone producing about 70% of the chips needed for the Chinese market. At the same time, post-pandemic supply chain disruptions, coupled with the war in Ukraine, have only reinforced the determination of many governments, including China and the US, to “onshore” semiconductor manufacturing providing resilience to possible chip shortages.

Subscribe and receive a weekly in-depth analysis on top international issues.

China to leapfrog foreign chip makers

It has become conventional wisdom that the Chinese semiconductor industry lags behind the US in chip design and patents, and behind Taiwan and South Korea in manufacturing. However, Beijing is striving to catch up with its competitors by introducing the most advanced chip design technologies. According to China’s 14th Five-Year Plan (2021-2025), one of China’s main goals in achieving its technological and material self-sufficiency is to pursue an industrial policy aimed at eliminating foreign dependence along the entire value chain. In this regard, the Chinese government has allocated tens of billions of US dollars for the development of the national semiconductor industry. The China Integrated Circuit Industry Investment Fund or the “Big Fund” was established in 2014 to support China’s homegrown chipmakers by providing massive funding and state endorsement. State financial stimulus has led to unprecedented progress in the Chinese semiconductors industry, allowing domestic producers to expand into this extremely saturated market.

The most famous Chinese chipmaker SMIC (Semiconductor Manufacturing International Corporation) has already become one of the most innovative players in the foundry business. Although SMIC accounts for only about 5% of the global manufacturing market, it is expanding rapidly and is already capable of producing 14 bnm chips. New rising stars are also shining on the horizon, such as YMTC (Yangtze Memory Technologies) in 3D NAND technology or Shanghai Micro, which successfully delivered the first advanced 2.5D3D packaging lithography machine in February 2022. The latter machine is expected to play a crucial role in the Chinese Integrated circuit industry.

Western experts tend to underestimate China’s technological potential, highlighting its inability to produce the most advanced semiconductors and even criticizing the Big Fund’s investment mismanagement, which has led to bribery investigations and unfulfilled dreams. At present, China is still two generations behind Western countries in chip manufacturing sophistication, but the pace of its progress in the chip industry is breathtaking. In just one decade, China has gone from being a rookie to a serious global competitor in the industry. Over the last four quarters, 19 of the world’s 20 fastest growing chip companies come from China and China is especially strong in producing According to Harvard report, China could join a “top league” producers in the semiconductor industry by 2030.

New chip alliance fuels geopolitical rivalry

Amid ever-deteriorating US-China relations, and in response to China’s advances in chip manufacturing methods, Washington recently called for a new chip manufacturing alliance formed by US allies, including Taiwan, South Korea and Japan. The Chip 4 Alliance is a proposed US-led advisory body to discuss sustainable chip supply chain management, training qualified personnel, and collaborative research and development in the semiconductor sector. Although Taiwan and Japan have already reacted positively to joining the Chip 4 alliance, Korea is still hesitant, fearful of possible Chinese retaliation. Another reason for the Korean government’s caution is that China (including Hong Kong) accounts for nearly 60% of Korea’s semiconductor imports.

The creation of the New Chip Alliance and the recently passed Chip Act clearly demonstrate the US’s desire to continue to lead the way in technological progress along with its allies. At the same time, in an attempt to maintain Western dominance in this arena, the US is also widening a ban on export of 14bnm lithographic equipment to China, trying to keep China at least 2-3 generations behind the Western countries. But such measures could become counterproductive as they push the Chinese leadership to step up measures aimed at creating self-sufficiency in chip manufacturing.

Although China is not able yet to produce 3-5 nm chips, which are fabricated by the most famous Taiwanese company TSMC or Korean Samsung, it may use the latest technological breakthroughs in advanced packaging, allowing to package 14 nm chips into three-dimensional configurations in order to achieve the same results as the most-advanced TSMC chips. Increasing pressure on China and building isolated alliances could increase the likelihood that China will accelerate its ambitions to become the world’s most dominant chipmaker in the coming years.

About the author:

Marián Šeliga is a China expert currently working as a Head of China desk at the Czech J&T bank. He earned master’s degree in Regional studies with a focus on China from Moscow State Institute of International Relations (MGIMO) as well as PhD degree in World Economy from the Plekhanov Russian University of Economics. His doctoral dissertation and current research focuses on the economic and political relationship between the US and China.